Housing Market Update

Mortgage interest rates play a crucial role in determining the overall cost of your home loan and monthly payments. Understanding how these rates work and what factors influence them can help you make informed decisions when applying for a mortgage.

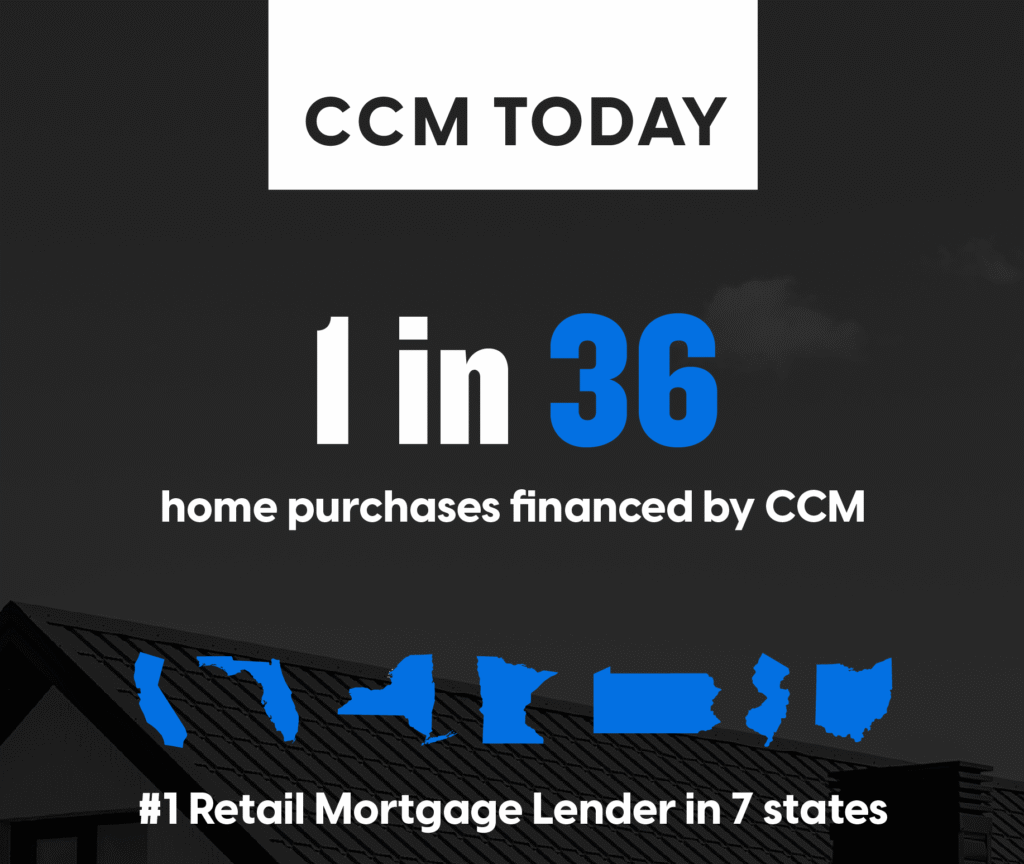

Did you know…CCM is the nation’s #1 retail mortgage lender

5 Things to Know About This Week’s Housing Market

The housing market is sending mixed signals this week, with steady rates but shifting demand. Here are the key takeaways you should know:

- Rates stayed about the same.

- Mortgage rates haven’t moved much because the 10-year Treasury (which helps set rates) is holding steady around 4.18%.

- Fewer people applied for mortgages.

- Mortgage Bankers Association reported that mortgage applications dropped by almost 13% compared to last week. That means fewer buyers are jumping in right now.

- Fewer new jobs showed up.

- The ADP National Employment Report for September showed private-sector jobs decreased by around 32,000, a sign the job market may be cooling.

- The government shutdown began.

- The federal government shutdown began Wednesday, meaning some of the usual reports on jobs and inflation won’t be released until the shutdown ends.

- What this means for you.

- If you’re a buyer, less competition could make it easier to negotiate.

- If you’re a seller, steady rates mean there are still serious buyers out there.

- If you’re a homeowner, refinancing may still make sense if rates move in your favor.

Previous 2025 Updates

Catch up on housing trends and mortgage news

-

- Fed lowers benchmark interest rate

- This may be a good time to review your options

- Also other updates happened

- Such as event 1, happening 2, and change 3

- The housing market also had some major updates

- Those were observed by all major mortgage lenders

- Fed lowers benchmark interest rate

-

Here’s additional text added to the page

- Subpoint 1

- Subpoint 2

- subpoint 3

-

Here’s additional text added to the page

- Subpoint 1

- Subpoint 2

- subpoint 3