Nationally, first-time homebuyers are facing daunting affordability challenges. Yet in several Midwestern states, younger buyers are breaking through the barriers to homeownership.

The national first-time homebuyer struggle

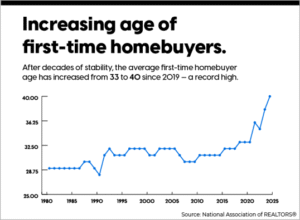

The 2025 Profile of Home Buyers and Sellers from the National Association of REALTORS® shows that first-time homebuyers now make up just 21% of all home purchases, down from the historical average of almost 40%. Even more surprising, the average age of a first-time homebuyer is now 40, which is the oldest it has ever been.

The new economics of buying young

Younger homebuyers are finding it harder to own a home. Recent data from the Home Mortgage Disclosure Act (HMDA) shows that the average home purchase for buyers under 35 was $398,000 in 2024, up from $285,000 just five years earlier.

Home prices are rising, interest rates are elevated and there aren’t many homes for sale. This has made it one of the hardest times to afford a home in decades.

How delayed milestones affect buyers today

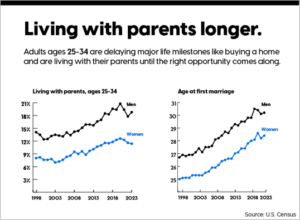

Changes in culture have also caused the delay. Many adults are holding off getting married, starting families or moving out of shared housing for longer periods of time. These are important events that usually happen around the time of buying a first home.

According to U.S. Census data, the average age of first marriage is now 30 for men and 28 for women. More than one in six adults under 35 still live with their parents.

Where younger buyers are doing well

But the national averages don’t tell the whole story. A lot of young people are still sitting on the sidelines, but some parts of the country are seeing more young and first-time homebuyers.

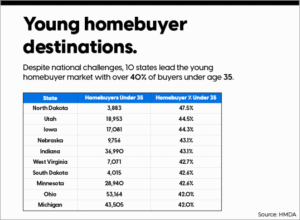

The Midwest and parts of the West have the highest percentage of homebuyers under 35, with some states having more than 40% of homebuyers in this age group.

- North Dakota leads the country among buyers under 35, with almost half (47.5%) of them.

- Utah has 44.5% of homebuyers under 35, driven by a younger population.

Iowa, Nebraska, Indiana, West Virginia, South Dakota, Minnesota, Ohio and Michigan all have more than 40%.

These states are quietly becoming good places for Gen Z to buy their first home. They are a rare ray of hope in an otherwise tough national landscape.

What makes these states unique

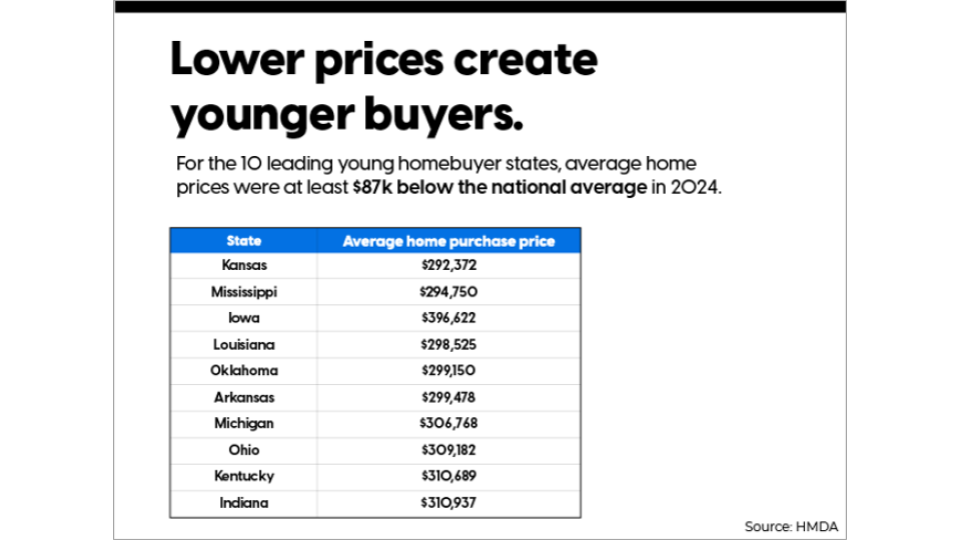

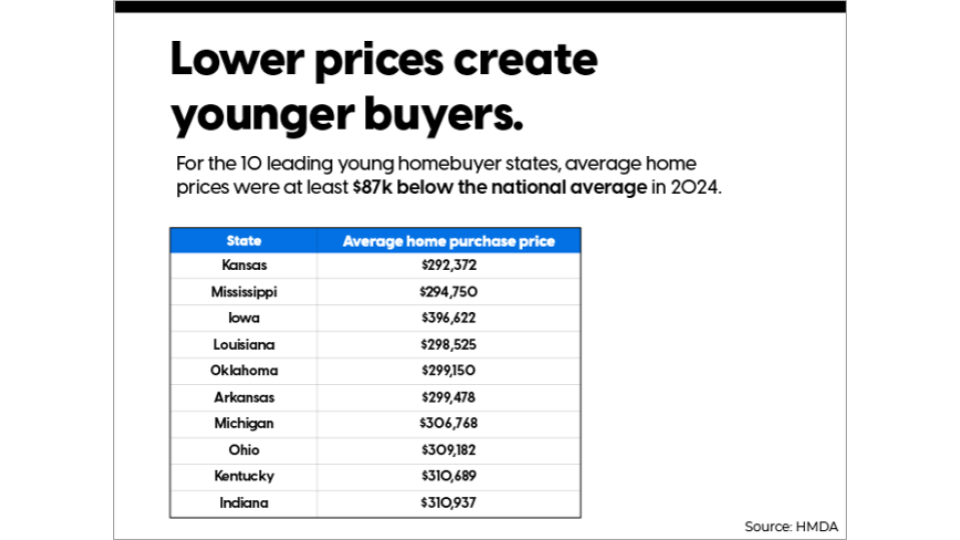

Affordability is the most obvious factor. In many Midwestern markets, homes cost almost $100,000 less than the national average of $398,000 for buyers under 35.

That lower entry point allows young families to buy homes sooner and start their journey to building equity faster than their peers in coastal metro markets.

Taken together, these factors make these states the exception to the national story — proving that while affordability challenges are widespread, homeownership is still within reach for many younger homebuyers in the right markets.

How mortgage lenders can help

Younger buyers are showing that the right financial tools and education can make a difference, even in areas where prices are higher. Mortgage lenders play a key role in helping first-time homebuyers navigate an increasingly complex housing market and discover programs that make ownership more attainable.

Here are some ways to get money that might help:

Low down payment options

- FHA Loans: Allow down payments as low as 3.5% and flexible credit requirements, making them ideal for buyers with limited savings or shorter credit histories.

- Conventional Loans: A strong option for first-time homebuyers, offering low down payment pathways and customizable financing terms.

Down payment assistance programs

Many state and local programs offer first-time homebuyers grants or loans that don’t need to be repaid to help with closing costs or down payments. People don’t use these programs enough, but they can help you go from renting to owning.

CCM Smart Start gives first-time homebuyers who meet the requirements up to $4,000 to use as a down payment. In many cases, this is enough to lower or eliminate the money you need to save for closing.

Educational support

In addition to loan products, your local loan officer can assist you with budgeting and planning for your long-term financial future. They can help you feel good about your choices and be ready to own a home.

No matter where you live, lenders can help you buy a home by providing these tools, market knowledge and personalized support.

The bottom line

Nationally, younger buyers face mounting challenges. The average first-time homebuyer is now 40 years old, and first-time ownership has fallen to just one in five purchases — clear signs of how affordability pressures have reshaped the path to homeownership.

But the story has bright spots. Across the Midwest and select states like Utah, thousands of younger buyers are becoming homeowners in markets where prices align more closely with incomes and community ties run strong.

TERMS & CONDITIONS: CrossCountry Mortgage LLC will contribute 2% down (up to $4,000) towards a 3% down payment. Homebuyer is responsible for the remaining 1% of the down payment. This offer is available for the purchase of a primary residence only. Offer valid for homebuyers when qualifying income is less than or equal to 80% area median income based on county where property is located. At least one occupying borrower must be a first-time homebuyer. Rate must be locked on or after 6/20/2023. Not available with any other discounts or promotions. Not available for customers with greater than 50% AMI in the following MSAs: Miami, FL, Atlanta, GA, Chicago, IL, Detroit, MI, St. Louis, MO, Philadelphia, PA, Memphis, TN, El Paso, TX, Houston, TX, McAllen, TX. Offer cannot be retroactively applied to previously closed loans or loans that have a locked rate. This is not a commitment to lend. CrossCountry Mortgage, LLC has the right to accept, decline, or limit the use of any discount or offer. Acceptance of this offer constitutes the acceptance of these terms and conditions, which are subject to change without notice. Additional conditions may apply. CrossCountry Mortgage, LLC is an FHA Approved Lending Institution and is not acting on behalf of or at the direction of HUD/FHA or the Federal government.